Restricted Stock Units (RSUs) are among popular equity compensation strategies for incentivizing employees in fast-growing private companies that anticipate going public in the near future. Although RSUs have been around for decades, their mainstream traction shot up dramatically in the last decade, with the number of companies issuing the compensation package growing to 74%.

It’s important to understand that an RSU package constitutes an employer’s promise to grant you a certain number of shares in the company’s stock after a predetermined time frame. The period before the shares are transferred to you is known as vesting and ends after meeting certain conditions, known as “restrictions.” After the vesting period, RSUs can be treated like any other stocks, which you can decide to hold, transfer, or sell.

Restricted shares can be a life-changing compensation package, especially if the underlying company is destined for growth and success. By understanding how restricted stock units work, you can gauge their true value and make prudent decisions on when to hold, sell, or diversify your portfolio. Most importantly, knowing how to calculate RSU value helps you evaluate whether the compensation package aligns with your long-term goals. Don’t hesitate to visit a reputable financial advisor in Portland, Oregon, whenever you need clarity about the potential of your RSUs.

That said, here is a definitive guide to what are restricted stock units, highlighting the subject matter in detail. Keep reading to stay updated.

Types of RSUs

Let’s explore the different types of RSUs plus their unique advantages and disadvantages, based on the vesting conditions attached to them:

Time-Based RSUs

Time-based restricted stock units are vested based on a predetermined duration, which typically includes a cliff period that is preceded by regular vesting intervals. For instance, a typical RSU package of this type might include a four-year vesting period condition and a one-year cliff. This means. In this case, part of the shares will vest after the first anniversary of the grant, followed by annual vesting periods spread over the remaining years.

Pros

- Simple and straightforward for both employees and employers

- Highly predictable, which can be helpful during the financial planning

- Drives long-term employee retention

Cons

- Doesn’t correlate performance with the restricted stock

- Limited motivation

Performance-Based RSUs

As the name suggests, performance-based RSUs vest when certain conditions are met to complement the company’s overall performance target or goal. The conditions can include individual performance goals, such as meeting sales targets, or company growth indicators, such as increased revenue.

Pros

- Aligns performance with the RSUs

- Fosters reward recognition and opportunity differentiation

- Strengthens motivation and focus

Cons

- It might be complex in the long haul—it requires ongoing tracking of performance metrics

- Susceptible to disputes and subjectivity

Market Condition RSUs

Market condition restricted stock units vest on the basis of attaining certain market-related conditions. For example, the employer might promise to transfer a certain number of shares to employees after the company’s valuation breaks a certain milestone or the stock price reaches a certain ceiling.

Pros

- It aligns with market success to drive employee focus and motivation

- Greater transparency as anyone can assess the prevailing market conditions

- Higher chances of getting substantive rewards in the long haul

Cons

- You have limited influence over the outcome

- Market conditions are highly volatile and unpredictable, depending on the industry

Tax Implications of RSUs

Now that you understand what is restricted stock units are, as well as the pros and cons of each type, what are the tax implications of this compensation package? Well, your restricted shares in the company will be taxed in two stages:

- Upon vesting: the fair market value of the shares is classified as ordinary income upon vesting, which is taxable under federal, state, and other tax policies surrounding programs for employee benefits, such as Social Security. Employees are required to fill out their W-2 or similar forms, where the taxation rates will be determined by their tax bracket.

- Upon sale: shares acquired as restricted stock units can be taxed as short-term or long-term capital gains upon sale. The amount of taxes here depends on how long you hold onto the shares, your tax bracket, and the jurisdiction’s tax laws.

While an RSU calculator can help you estimate the amount of taxes you owe, tax laws are complex and dynamic. With that in mind, it is advisable to seek professional tax planning advice to determine the most appropriate approach toward financial planning.

Strategies for managing RSU taxation

You can employ a number of strategies during RSU planning to manage taxation, including:

Tax-loss harvesting: this includes selling other investments in your portfolio that are experiencing loss to offset the capital gains tax charged on the sale of RSU shares.

Hold and sell later: this strategy entails holding onto the stocks for the share price to gain a significant value and eventually qualify for a long-term capital gains tax incentive.

Make charitable contributions: donating part of the restricted stock unit shares can increase your eligibility for a tax deduction commensurate to the fair market value of the donated shares.

Vesting and Selling RSUs

Vesting schedules are timeframes established to meet predefined conditions before employees can exercise their rights to claim, hold, or sell company shares granted through restricted stock units. There are various types of vesting schedules, depending on the underlying restricted stock unit plan. They include:

- Time-based schedule, where the vesting of the RSI is tied to a predefined duration, usually measured in years but split periodically, e.g., quarterly or annually

- Performance-based schedule, where the vesting of the RSU is contingent upon obtaining specific performance targets, whether individually or as a company

- Market condition schedule, where the vesting of the RSU depends on the company meeting certain market-related conditions

After vesting, employees are allowed to claim their restricted stock units as listed company stocks, after which you can explore a range of options, including:

- Selling immediately: under this option, you can sell your RSUs immediately upon vesting to convert the shares into cash. However, it’s important to remember that the gains will be subject to ordinary income tax, depending on the share’s value.

- Selling at vesting: this option allows you to sell part of the RSU shares at vesting and hold onto the rest. This approach is viable if you want quick money to offset your current tax liability or cover ongoing financial needs. Depending on your long-term goals, you can engage an expert in financial planning for business owners to help you set up another revenue stream.

- Holding onto the RSUs: you can also choose to hold onto the shares and wait for potential long-term gains, especially if there is a high potential for the stock’s value appreciation. However, this approach requires a high-risk tolerance for market volatility since the stock price will likely fluctuate from time to time.

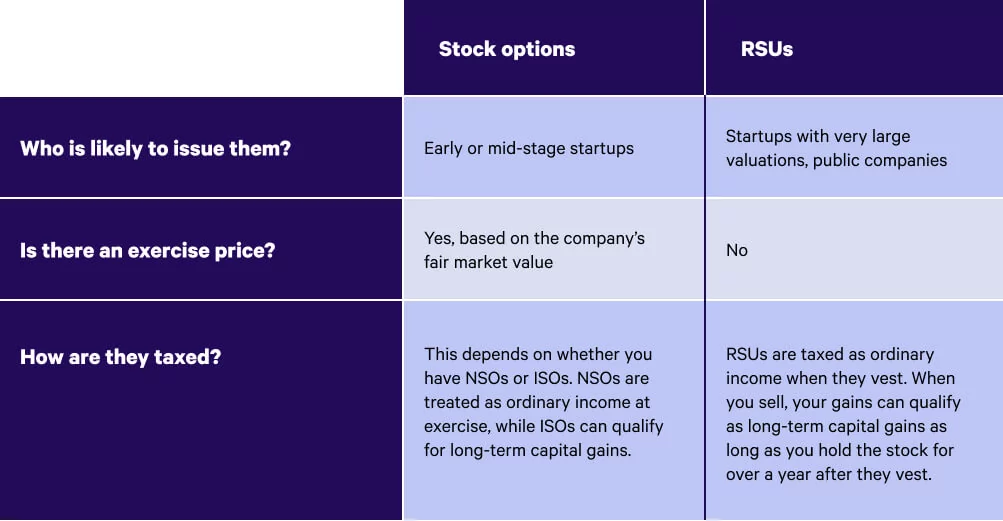

RSUs vs. Stock Options

RSUs and stock options are both popular compensation packages for employers who want to motivate and incentivize their employees to focus or contribute as much as possible to the company’s goals. However, the packages have key fundamental differences, as explained below:

While RSUs simply include an employer’s promise to grant you a certain number of company shares, contingent upon fulfilling set conditions, stock options give you the opportunity to outrightly acquire the company stock at a predetermined price.

RSUs are subject to ordinary income tax upon vesting, and capital gains tax is also charged on the subsequent gains or losses upon sale. On the hand, stock options are subject to tax, depending on the conditions granted. For instance, you might pay ordinary income tax upon exercising non-qualified stock options (NQSOs).

The pros and cons of RSUs vs. stock options

| Compensation Package | Pros | Cons |

| RSUs | -Simple and clear to understand for both parties -Enhances long-term retention for full value realization-High potential for long-term capital gains tax incentive | -Doesn’t give you immediate liquidity -Tax liabilities upon vesting |

| Stock Options | -High potential to offer immediate significant financial rewards if stock prices go up-Greater flexibility as the choice to buy the stock is optional-Incentive stock options (ISOs) have a lower tax impact | -Can result in losses if stock prices fall-Immediate ownership is contingent upon exercising |

Working with a Financial Advisor

Working with a financial advisor from a reputable company, such as Interactive Wealth Advisors, comes with valuable assistance in navigating the complex landscape of restricted stock units. Your financial advisor will go beyond the basics of what is an RSU to assist in planning and tax strategies, as well as investment and diversification strategies. On top of that, the advisor will take a custom approach to address your unique situation and recommend supplementary offerings, such as retirement planning services, to help you create a viable roadmap to achieving your financial goals.

Besides knowing how to calculate RSU tax and comprehending the associated liabilities, working with a professional financial advisor comes with a ton of other benefits, including:

- A wealth of expertise and knowledge that encompasses all realms of personal finance, including estate financial planning

- A long-term relationship backed with a fiduciary obligation on the advisor’s side to always act in the best interest of your financial needs and goals

- In-depth and strategic financial planning to incorporate the potential of the RSUs into your overall financial goal

- Personalized and holistic financial advice that caters to your unique case based on several factors, such as risk tolerance and time horizon

Don’t let your Restricted Stock Units (RSUs) become a mystery. Maximize your earnings with proper RSU stock planning. Learn more on our service page – your key to unlocking the potential of your stock options. Click here to take control of your financial future.

Conclusion

Understanding what is RSU income and how to fit it into your broader financial plans is important. Remember, you can only benefit from this compensation package after the vesting schedule ends.

Also, income generation options are numerous, including selling immediately, holding and selling later, or even selling at vesting—it all boils down to your financial needs.