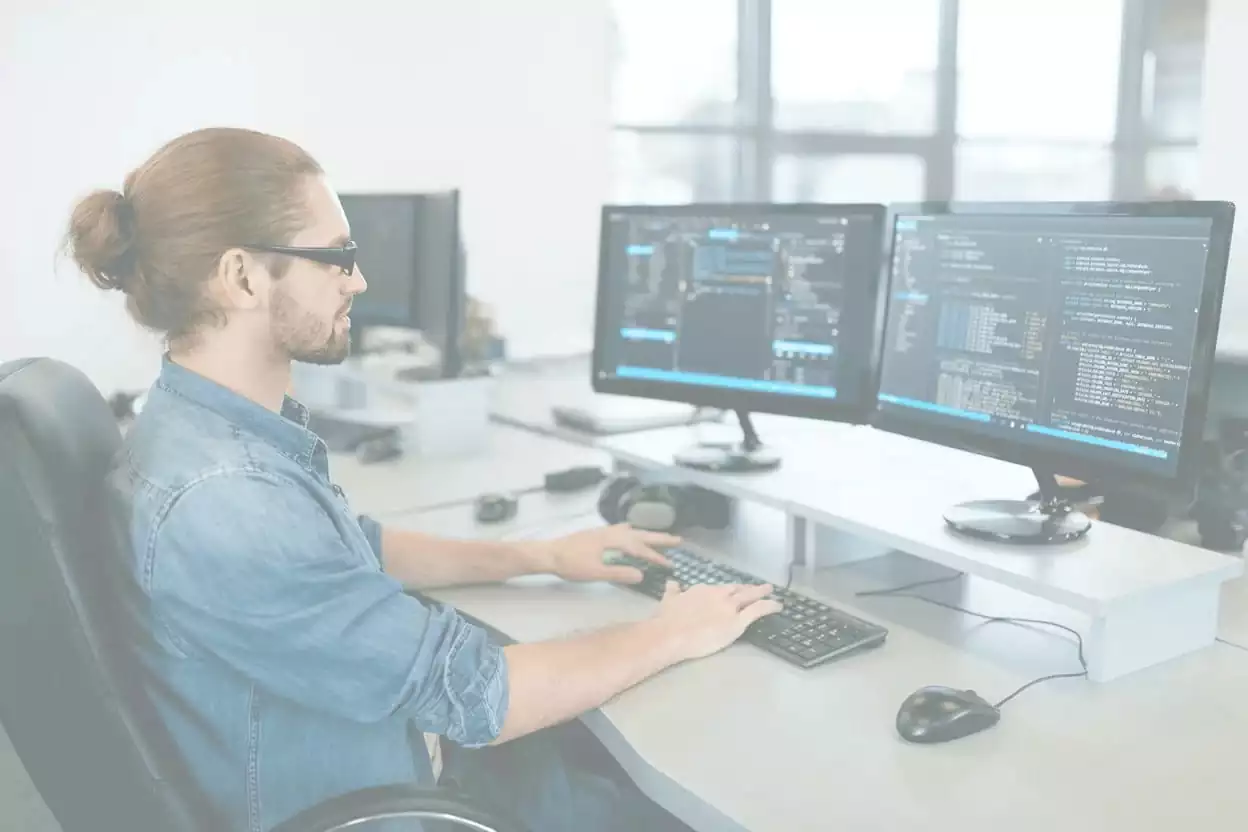

Successful retirement planning is not just about accumulating assets, it’s also about how to properly spend your assets. You need to minimize the guesswork involved in the most important retirement question: How am I doing?

Interactive’s retirement planning services guide you through the accumulation, preservation and ultimately spending of your wealth. Our retirement planning consultants help you organize the otherwise contrasting components involved:

- Tax-smart investing (taxable and tax-sheltered account management)

- Sources of retirement income (retirement plans, pension plans, Social Security and more)

- Spending plan based on your desired lifestyle as well as market conditions

- Estate planning needs

Interactive Wealth Advisors are committed to helping you reach financial freedom. If you need advice or help planning your retirement, please contact us.

Why People Hire Us

Retirement Planning Calculator

Try our Retirement Planning Calculator for an initial glimpse into your retirement future. While it’s a great starting point, retirement planning has many nuances. For a comprehensive and personalized strategy, trust Interactive Wealth’s seasoned tax planners and wealth advisors. Let us guide you towards a secure and prosperous retirement.

Our Process

How Can We Help?

Who is it for?

Retirement planning is critical for anyone who wants to ensure a comfortable retirement. While there are many different aspects to retirement planning, one of the most important is figuring out how much money you will need to save each month to have enough cash available when you retire.

What Exactly is Retirement Planning?

Retirement planning involves analyzing your options today, in order to secure your financial future tomorrow. At Interactive Wealth Advisors, you and your financial advisor for retirement planning will formulate a plan built around your current reality and your post-retirement goals. Knowing how much of an income stream you’ll probably require in the future will enable you to make smart choices about how to leverage your income, savings, investments, and employer-sponsored or other retirement plans.

Each retirement plan is unique as different Portland neighborhoods. But no matter who you are, we’ll help you gain control over the big retirement traps like Social Security, post-retirement health care insurance coverage and taxes. For some people, retirement may be an eagerly anticipated event, an opportunity to enjoy so many things that you couldn’t do while working like travel, hobbies, and more family time. For other people, even the word “retirement” may conjure up feelings of fear or dread. Newspaper stories abound about the collapse of Social Security adding anxiety to already scary topic. However, whether you think you’re financially comfortable or not totally sure, retirement planning can help you take control of your own future.

How Much Retirement Income Do You Need?

First, you’ll want to evaluate your current reality like your income, expenses, assets, and debts. Next, you’ll need to think about what you want your future to look like and how much that lifestyle could potentially cost. The four main sources for your retirement income are Social Security, pensions, your investment portfolio, and savings. Our retirement planning advisor’s analysis will determine if you’re on track or if we need to take course correcting steps today to get you back on track.

You’ll not only want to think about your future sources of income, but also about where you’ll live. Are you going to stay in Oregon or move out of state? Will you continue to live in your current home or will you move to a condominium or retirement community? And if your employer ever offers an early retirement package, you’ll need to know how to evaluate that when the time comes.

Saving for Retirement?

Learning how to save for retirement is imperative. There are a number of retirement vehicles available, including traditional and Roth IRAs, employer-sponsored retirement plans, nonqualified deferred compensation plans and stock plans. Proper retirement planning requires understanding what’s available to you and which tools will help you reach your goals. For example, should you use a Roth 401k or the traditional 401k offered by your employer? As tax laws change, you’ll need to reevaluate your strategy to make sure it’s optimized for today and tomorrow.

Distributions from IRAs and Other Retirement Plans

Effective retirement planning involves not only an awareness of the types of savings vehicles available, but also an understanding of taking distributions from these vehicles. We’ll walk you through the income tax ramifications of distributions and make sure you avoid any tax penalties. Should you borrow money from your retirement plan? Is it better to receive your retirement money in one lump sum or in monthly checks? Should you roll your retirement plan balance into an IRA? What are the advantages and disadvantages of each?

In addition, you may be concerned about naming one or more beneficiaries for your IRA or employer-sponsored retirement plan. What are the tax implications? What about required minimum distributions from the plan after you reach age 70½?

Executive and Business Owner Strategies

A number of additional retirement planning tools are often available for executives, such as nonqualified deferred compensation plans offered by employers to their key employees. If you’re an executive, you should realize that nonqualified plans and stock plans can be valuable tools for retirement planning. You should understand the mechanics of the special benefits afforded by your employer, including the tax implications for you.

If you are a business owner, on the other hand, you have some special retirement planning concerns of your own. In particular, you may want to plan for the succession of your business to family members or to others. You may also want to know which retirement plans are best suited to your form of business. Should you set up a defined benefit plan? Should I sell my business? If so, how do I maximize its value?

Social Security Strategies and Retirement Planning

If you’re planning for retirement, you also want to factor in your future Social Security income. What are your estimated Social Security benefits? Is that number reasonable or should you assume you’ll get less? Is your Social Security income record accurate and complete? If not, how do you correct it?

An Interactive Wealth Advisors retirement consultant will also help you become familiar with ways to optimize your Social Security benefits and minimize their taxation. The timing of your receipt of benefits can be important, as can the impact of post-retirement employment. Other governmental programs should also be considered when planning for retirement.

In particular, you should review the topics of Medicare. You should know what Medicare does and does not cover and what other health care options are available to you. How expensive are these governmental and supplemental health programs? What are the eligibility requirements? Medicaid planning can be particularly important for people of modest means. You should know the Medicaid eligibility requirements, the penalties for transferring assets inappropriately, and the various strategies available for protecting assets. In addition, you should become familiar with the specific methods of protecting your personal residence and the extent to which your state can impose liens on your property and pursue recovery remedies after your death.

If you are planning for your post-retirement years, you should also gain some familiarity with long-term care insurance, nursing homes, retirement communities, assisted living, and other housing options for elders.

Learn How Our Retirement Planning Could Help You with a complimentary consultation.

Why choose us?

Interactive Wealth Advisors is a retirement planning firm that uses cutting-edge technology and strategies to help clients achieve their desired retirement. We offer various retirement planning services, including:

- Asset management

- Retirement planning

- Estate planning.

We want our clients to enjoy their retirement years to the fullest. We offer a wide range of services that help them achieve their retirement dreams. We believe that our clients deserve the best possible retirement plan, and we are dedicated to helping them reach their financial goals.

Frequently Asked Questions

What is retirement planning?

The most important thing is to have a dialogue with a local financial advisor, as they will be able to help you develop a plan that is tailored to your individual needs. They will also be able to guide how to best use available resources and make informed investment decisions.

Why should you do retirement planning?

You need to do a few key things to make the most of your retirement years. First, you need to set aside money each month to have a cushion. Second, you need to make sure that you have a solid retirement plan. This will include employer contributions, 401k plans, and other investment options. Third, make sure that you take advantage of all of the available retirement benefits such as social security, Medicare, and Medicaid. Finally, make sure that you are keeping up on your taxes by using a firm that understands retirement tax planning in Portland.

Is it worth hiring a financial advisor for retirement consulting?

A financial advisor can also help you identify potential risks and vulnerabilities in your retirement portfolio. This is important if you are not yet retired, as it can give you peace of mind if you experience a downturn in the stock market or other market conditions. Finally, hiring a financial advisor can free up your time to focus on other priorities in life.

How can Interactive Wealth Advisors help?

How much does it cost?

What factors should I consider when choosing a retirement planning service?

-

It is important to choose a reputable consulting business as your retirement planner. Key factors to consider include:

- Expertise and track record

- Range of services on offer

- Fees structure

- Compliance and security

- Compatibility and personal connection

Retirement planning is a long-term process. That’s why you must ensure your service provider is accessible and understands your individual retirement goals.

How much will I need to retire (considering inflation, health care, additional travel and other retirement costs)?

The exact amount needed to retire will differ according to your desired lifestyle, your current and expected retirement age. Location and investment returns also play a role. A quick estimate takes into consideration expenses upon retirement like housing and healthcare, the inflation rate,life expectancy and income. You can contact a retirement professional to help you calculate exact figures.

How much should I be saving each year so that I can retire?

The amount of money you should be putting towards your retirement plan annually depends on your desired retirement age and lifestyle. A retirement financial advisor will also assess:

- Retirement savings goals

- Current savings and investments

- Saving period and savings rate

- Expected investment returns

Also regularly review and adjust this figure as changes to your income, savings and investment returns occur.