Since dividend investing took the financial world by storm, investors have continued to seek opportunities with sustainable yields. But what exactly is dividend investing?

Dividend investing simply involves strategically investing in stocks that pay dividends to generate a reliable income stream, build wealth, and ensure financial security.

Whether you want the dividends to fund retirement financial planning for business owners or enjoy long-term income growth and capital appreciation, there is one common goal when investing in dividend stocks — reducing risk through effective dividend stock investment strategies. So how can you maximize dividend stocks and ensure successful investing?

Well, see our seven rules of dividends every savvy high-dividend investor should consider when investing—from finding sustainable companies with good yields and payout ratios to exercising unwavering discipline and patience.

Rule 1: Look for companies with a history of paying dividends

A company with a track record of paying dividends is an essential factor to look for in a dividend stock to avoid investment loss. That is because it demonstrates the company can sustain its payout even if there is a short-term decline.

When investors assume a company cannot sustain dividend payments, they reduce the stock price and prepare for a cut. Eventually, when there is a cut, the stock will continue to dump as investors leave. Also, most large investors, like investment funds, will reduce their positions or even sell everything if no dividends come from the company.

To identify companies with solid dividend stocks, check the percentage of the company’s profit that is used to pay dividends. If the company pays less than 50 percent of its profit as dividends, there is an increased possibility that it will continue to pay even with a short-term downturn.

Companies like The Coca-Cola Co, Exxon Mobil Corporation, and Procter & Gamble Co. (PG) have sustained payouts since the 1880s. Investors can also review the stock market in lists such as Dividend Aristocrats to find companies with a long-term history of maintaining and growing payouts.

Rule 2: Focus on dividend growth

Investors often focus more on a stock’s current high yields and ignore the payout growth over time. This is an investing error, especially since the increase is essential to cushion the effects of inflation. Plus, if you’re looking to invest for decades or considering ETF with dividend reinvestment, a growing payout will ensure you can handle the rising costs of managing your portfolio.

These factors can help investors analyze a company’s growth dividend investing:

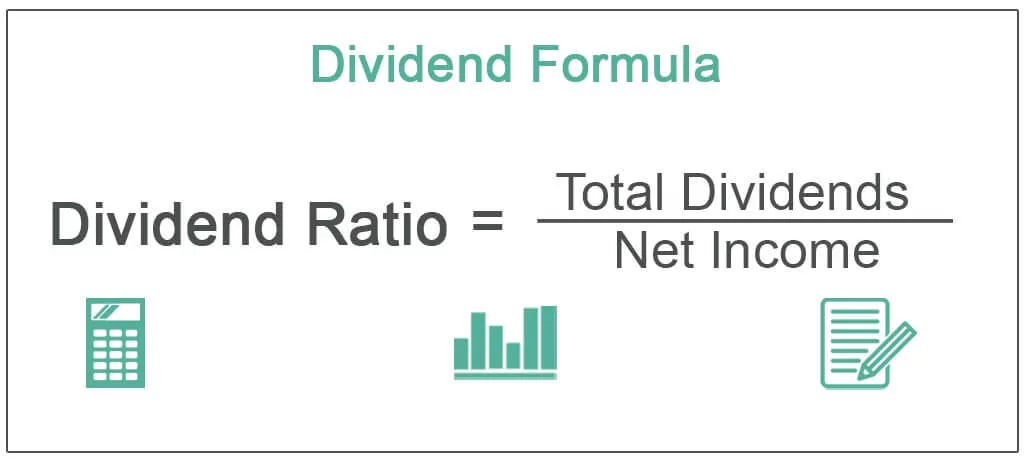

- Dividend payout ratio: This is the ratio of dividends to entire profits. The goal should be finding firms with lower payout ratios since that increases the chances of the company raising its dividends successfully.

- Dividend growth rate: This shows how often a company raises its dividend. Higher figures often indicate the willingness of shareholders to pay more overtime.

- Earnings growth rate: Companies that grow their earnings can realistically grow their dividends, too. So, if a company has a stable 10 percent annual increase, it could also grow a dividend sustainably at that rate.

Companies like AbbVie Inc., The Coca-Cola Company, and Becton, Dickinson and Company have steadily raised their dividends over the years.

Rule 3: Pay attention to the dividend yield

The dividend yield is the ratio of a company’s percentage annual dividend payment to its stock price. Investors often check the dividend yield to evaluate the income investing potential of a stock. That is because a high dividend yield indicates that a company is paying out a larger percentage of its profits, which makes it an attractive investment for income-oriented investors.

You can calculate the yield by dividing the annual dividend per share by the current stock price and multiplying the result by 100. For example, if an investor’s portfolio increases from $1 million to $1.3 million in five years, that is a 5% annual return. If he targets an annual dividend income strategy of $40,000, he can achieve the income goal in year one if he targets a 4% yield i.e., 4% x $1 million = $40,000.

If he also targets an annual income growth of 2.5% to cushion inflation effects, he would require a little more than $45,000 in annual dividend income in five years.

That means with his portfolio worth 1.3 million, he only needs dividend plans to yield 3.5% to hit his goal.

These companies employ remarkably high dividend strategies:

- Petroleo Brasileiro SA Petrobras (PBR) with 75.9%

- ZIM Integrated Shipping Services Ltd. (ZIM) with 72.5%

- Ecopetrol SA (EC) with 32.4%

- CVR Partners LP (UAN) with 27.9%

Ultimately, while buying stocks with high yields generate more total returns, investors approach them cautiously, as they are often not risk-free.

Rule 4: Diversify your portfolio

Diversifying your portfolio is the financial interpretation of not putting all your eggs in one basket. That is to ensure effective investment management and prevent your future dividend earnings from plummeting during a market downtown.

When you spread your assets out over dividends stocks like The Coca-Cola Co., JPMorgan Chase & Co., Verizon Communications Inc., or Cisco Systems Inc., it diversifies your holdings to minimize risk and protect your passive income. So, if dividends in one area face a downturn, the loss will be cushioned as other stocks continue to perform.

To learn how to build a dividend portfolio, review the potential companies with reliable yields on your list and wait for the best price to buy in. Also, check before buying dividend stocks on a margin and be wary of yield traps – the high yields will not mean much if they are not sustainable.

Rule 5: Monitor the payout ratio

The payout ratio shows what portion of earnings are allocated to dividends so you know how to pick a dividend stock. You can determine if a company’s current earnings can adequately support the payment promised when you divide the dividend by earnings per share as shown below:

Dividend Payout Ratio= Dividend per share (DPS)/ earnings per share (EPS)

If a company has a ratio over 100%, it is a red flag for long term dividend investing because it means they pay out more than they make. Even though there is no perfect percentage for a payout ratio, figures close to 100% are often problematic.

Smaller percentages, between 35% and 55%, show that the firm only gives out a portion of its earnings so you can continue earning back your investment even during short-term downturns.

Companies like HP Inc., with a payout ratio of 23%, Intel Corp, with 41.5%, Cummins Inc., with 33%, and Target Inc., with 25%, have healthy payout ratios.

Rule 6: Stay disciplined and patient

To successfully build your dividend portfolio into a dividend generator, you will need a lot of discipline and patience for the long term. When you find your solid dividend-paying firms, invest early and reinvest dividends consistently over time.

The major challenge with discipline in wealth management planning is emotions – keep them at bay! Even when there are downtimes in a stock, insulate yourself against external factors and stay the course.

Diversification also helps, too. While there may be some “surefire” opportunities with mouth-watering investment returns, allocating your portfolio across different dividend stocks to buy and hold will protect you in the long run.

From Warren Buffett’s experience with the buy and hold strategy, we saw that Berkshire purchased 400 million shares of the drink company for about $1.3 billion. Now, nearly three decades later, the stock has risen, to about $25 billion, as of June 2022 and is due to pay out about $700 million this year to Berkshire.

Also, there is Peter Lynch, who managed the Fidelity Magellan Fund from 1977 to 1990, and in that time, the fund’s assets grew from $18 million to $14 billion.

Rule 7: Be patient

According to Warren Buffett, “My favorite holding period is forever.” Patience in investing allows reliable companies to compound your wealth over time with their strong competitive advantages. For example, a $1,000 investment in Coca-Cola 25 years ago would now be about $14,900 (plus dividends).

Also, it is a tax-advantaged strategy. An expert tax planning advisor will state that if you operate a taxable account, there will be capital-gains taxes to pay when you sell a stock. But if you don’t sell, you do not have to pay any taxes on dividend reinvestment, and your money keeps compounding.

Additionally, leaving your stocks reduces portfolio turnover. That means lower frictional costs like brokerage transaction costs, slippage, etc., and more money you have to actually invest.

To achieve this, research the blue-chip stocks to invest for dividends and stay consistent. Diversify your portfolio, keep your emotions in check, and have significant savings you can access for emergencies. These will help you keep your hands away from your “cookie jar” and secure your portfolio.

Key Considerations

By following these rules of dividend investing, you can add exponential value to your portfolio. Interestingly, the key secrets of great investors lie in knowing sustainable companies offering the strongest returns and payout ratios while minimizing risk and maintaining diversity.

While recognizing the firm discipline and patience investing demands, it is a prudent step towards retirement planning and, ultimately, financial freedom.

So you, too, can begin your dividend-investing journey. And if you are wondering how to invest in dividend stocks, the good news is that you do not have to do it alone. With Interactive Wealth Advisors, you can enjoy the hassle-free benefits of investing and effective risk management.

Our professional advisors have years of experience in dividend investment strategy to help you find the ideal companies that align with your unique financial goals.