According to the Investment Company Institute (ICI), by September 30, 2022, the total US retirement entitlements were a whopping $39.2 trillion, comprising a 401(k) plan of $8.9 trillion and an individual retirement account (IRA) of a massive $11.0 trillion.

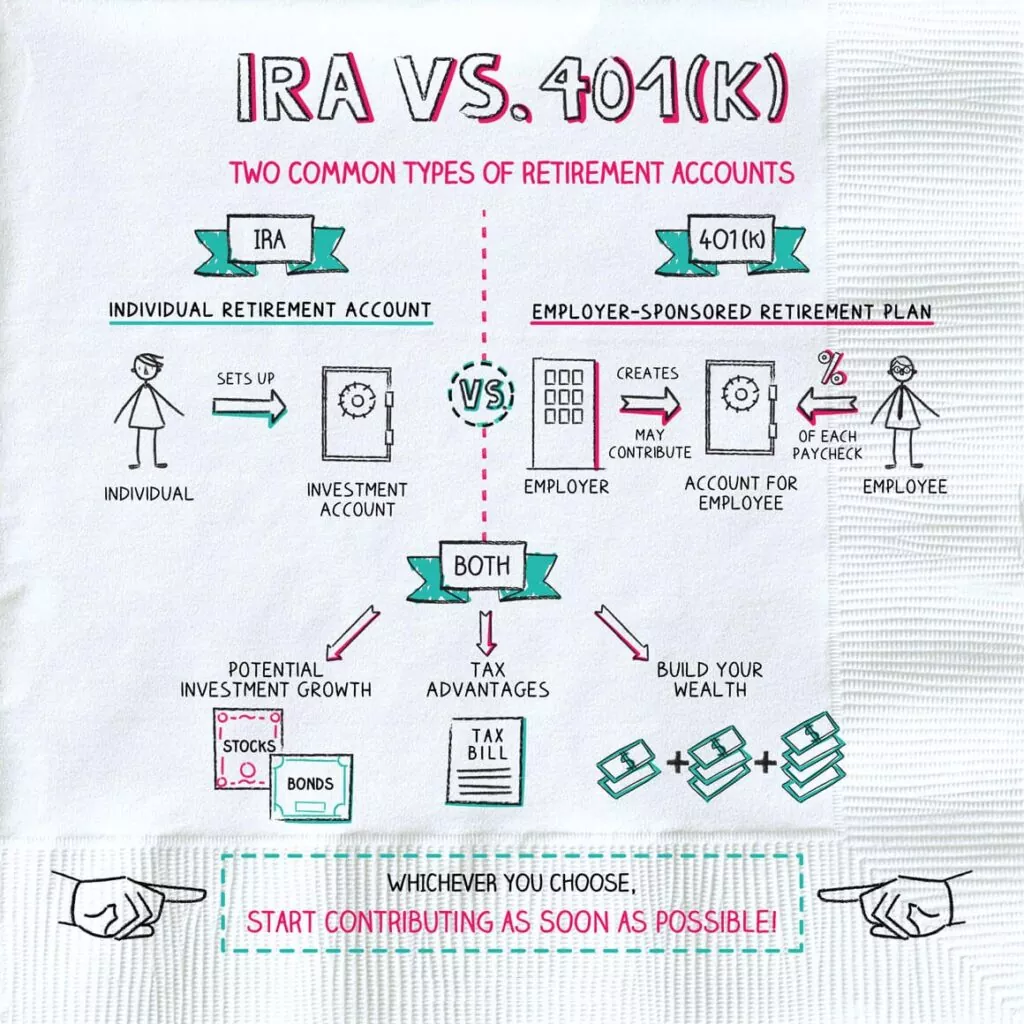

This shows the undeniable rise in demand for retirement accounts. But since IRA and 401k offer similar benefits, including tax-deferred or tax-free investment growth, the accounts are often mistaken. Interestingly, these plans have distinct features, eligibility requirements, and constraints.

Before now, there wasn’t as much concern for the differences in these options. But with the increasing household adoption of professional retirement planning, there is a growing awareness and need to explain an IRA and 401k carefully

Below are the significant differences between IRA and 401k plans. Depending on your unique retirement situation, we will discuss which option fits you best.

The Quick Answer

Although both plans offer significant tax benefits, the difference between a 401k and IRA is that employers provide 401(k)s, while individuals open and control IRAs via brokers or banks.

Let’s see two cases to further explain the IRA vs 401k comparison:

Case 1: Your employer offers a 401(k) with a company match

Not every company offers employees a 401k, but if you get an offer with a company match, contribute at least the minimum amount to match that contribution and get the complete return on investment.

When you get the match, you can consider an IRA and max that for the year before going back to continue your 401k contributions.

Case 2: Your employer doesn’t offer a company match

In this case, you can start by opening an IRA with a broker. This will give you access to several investment opportunities and save you the administrative fees of some 401ks. The limitless possibilities are significant examples of how an IRA is different from a 401k. When you max the IRA, consider funding your 401k to enjoy its pre-tax benefits.

Key Takeaways

- While you can open an individual retirement account, only your employer can open a 401(k) retirement account to match an employee’s contribution.

- IRAs and 401(k)s have traditional options you fund with pre-tax dollars.

- You can fund Roth versions of the IRAs and 401ks with post-tax dollars.

- You can contribute to an IRA and a 401(k) if eligible.

- 401k plans are tax-deferred retirement accounts.

- Individuals can open a traditional IRA or Roth IRA with a bank or broker without an employee matching.

- IRAs offer you more investment choices than 401(k)s. However, the allowed contribution levels for 401ks are significantly higher.

At Interactive Wealth Advisors, we understand that successful retirement planning isn’t just about asset accumulation; that is why our financial advisors will help you reduce the guesswork in retirement planning.

Our experts in retirement planning in Portland, Oregon, will walk you through the accumulation, preservation, and spending of your wealth. And because Interactive Wealth Advisors are committed to helping you reach absolute financial freedom, we will also help with the following:

- Tax-smart investing (taxable and tax-sheltered account management)

- Sources of retirement income (retirement plans, pension plans, Social Security, and more)

- A spending plan based on your desired lifestyle as well as market conditions

- Estate planning needs

Is a 401(k) an IRA?

If you have ever asked: “Is an IRA a 401k?” or “Is an IRA same as 401k?” The answer to both questions is yes. A 401k is a type of Individual retirement account (IRA) or retirement account, so, like the 401k plans, IRA holders can start withdrawing their investment once they turn 59½ years old.

Although the 401k is an individual retirement account with a similar goal of preserving your wealth for post-retirement, the contribution source is the main difference between a Roth IRA and 401k.

While the 401k is employer-sponsored, anyone can open an individual retirement account, whether Traditional or Roth, via brokers, banks, etc.

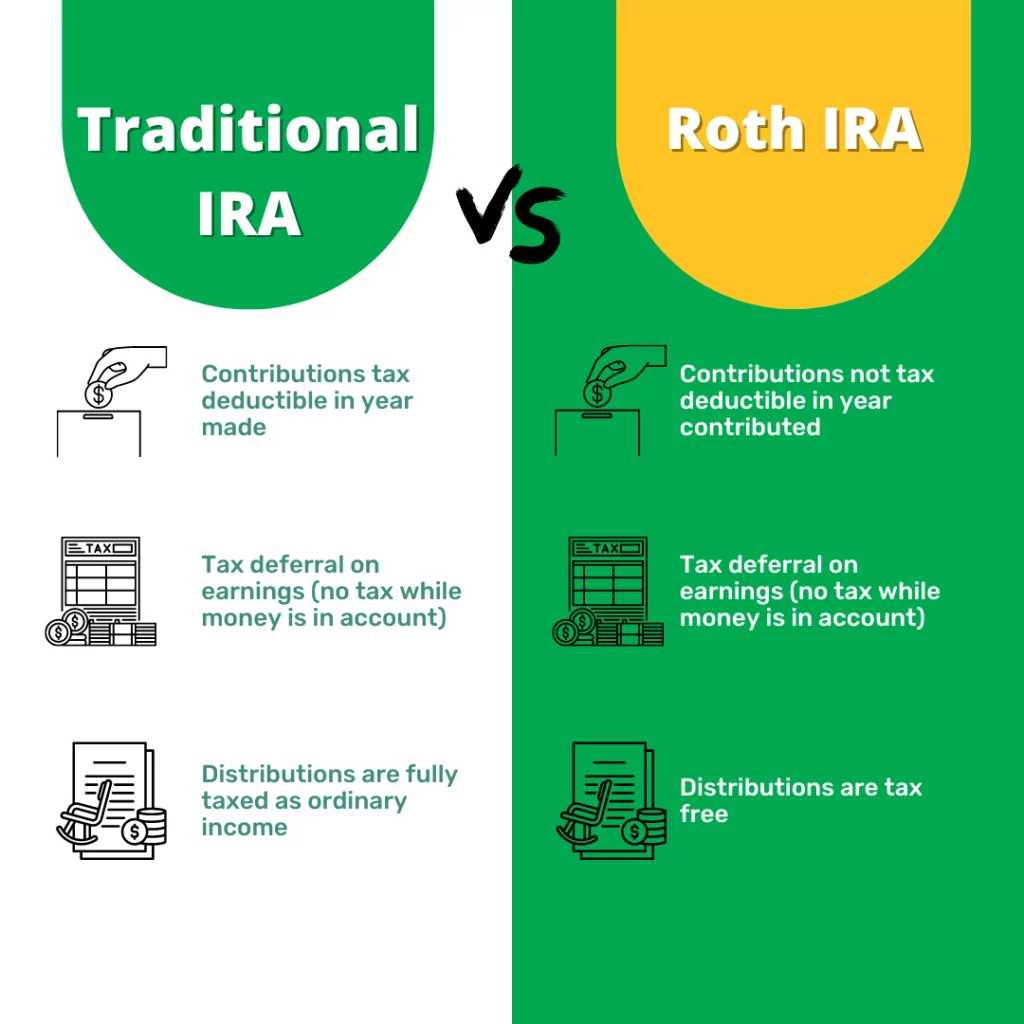

Also, the IRA and 401k retirement accounts handle taxes and offer benefits differently. Although there are no tax deductions for contributions with Roth IRAs, withdrawals after retirement are entirely tax-free.

With Traditional IRAs, you get a tax deduction, while 401ks allow you to fund your account with pre-tax money, ultimately reducing taxable income in the year you contributed. But the distributions in retirement from 401ks and IRAs are considered taxable income. Plus, unlike 401k plans, the IRS does not permit borrowing against your IRA account balance.

As easy as it might sound, planning for retirement with a good salary can be pretty demanding if not daunting.

IRA Overview

An IRA is a retirement investment account individuals can open through a bank, credit union, investment firm, broker, or mutual fund provider.

An individual retirement account allows people with income to save for retirement with their spouses while enjoying tax-free or tax-deferred benefits (depending on the type), a better compound rate, and ultimately more money accumulated for retirement.

An IRA account has a yearly contribution limit of $6,500 in 2023 unless you are over 50 years; then, you can add an extra $1,000 every year. Fortunately, the contribution limit is not fixed; it usually increases every few years.

Traditional vs. Roth IRA: Core Differences

There are two main types of IRAs, Traditional and Roth, and their significant difference lies in the advantages of IRA taxes.

Traditional

Traditional IRA investment will allow you to fund your retirement account pre-tax. That means your contributions to the account will be tax-free. So your account balance can grow tax-deferred until you withdraw in retirement. However, upon withdrawal, you’ll pay taxes at ordinary income rates, and after 73 years, you’ll have to take the required minimum distributions yearly. Tax deductibility depends on your income and if there is a 401k.

Roth

In this case, you will save for retirement with post-tax money, so there will be no tax break on contributions. However, you can grow your money tax-free and withdraw tax-free in retirement. Plus, unlike the traditional option, you don’t have to take minimum withdrawals and can pass the money to your heirs tax-free. The Roth has income limitations, so the more you make, the less you can access.

401k(s)

The 401k is a retirement account that only an employer can open, so if your company offers it, select an amount to contribute to the account. Some companies also offer to match your companies, so your first target should be to match the contributions from your employer to enjoy those benefits of a 401k vs IRA.

Additionally, depending on the account your employer offers, you could get investment options, like mutual funds or exchange-traded funds. You can also explore any of the suitable options for more ROI.

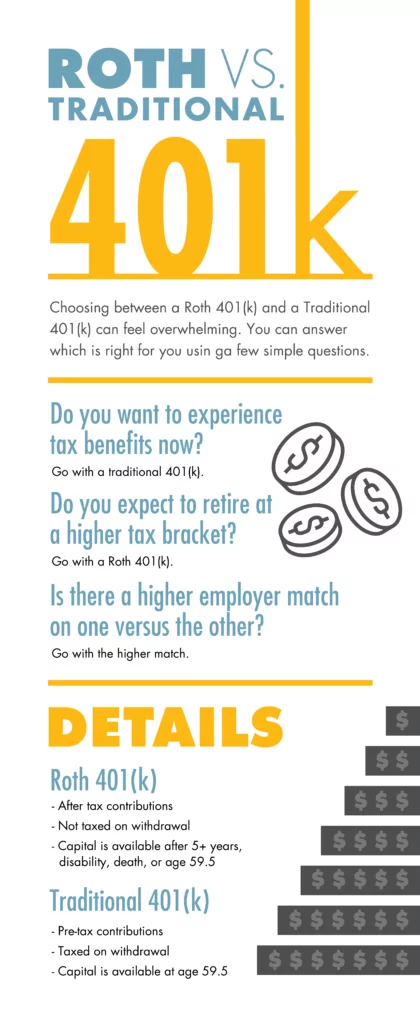

Traditional 401(k) vs. Roth 401(k)

Interestingly, the significant difference between the traditional and Roth is when they’re taxed.

For traditional 401k, you can make contributions with pre-tax dollars. That way, the contributions, and earnings appreciate tax deferred. But, when you withdraw the money in retirement, the Internal Revenue Service (IRS) considers it as income to be taxed at the current rate.

In comparison, you make contributions from Roth 401(k) with after-tax dollars, and you can withdraw the contributions and earnings in retirement completely tax-free.

Key Differences Between 401(k)s and IRAs

Here are some key differences for the 401k versus IRA comparison:

Annual Contributions and Limits

According to the 2023 data, employees with a 401k can contribute up to $22,500 to their accounts. But employees 50 years and over can contribute an extra $7,500.

However, with an individual retirement account, account holders can only contribute a maximum of $6,500, or an annual sum of $7,500 for individuals 50 years or older.

Withdrawal Conditions

Now, besides the traditional IRA versus 401k comparison, you can start withdrawing funds from a 401(k) plan and a traditional IRA at 59½ years (not earlier to avoid the 10% penalty fee). However, for a Roth IRA, when you keep the account for five years, you are not penalized for early withdrawals of your contributions, and there is no age restriction. Earnings on your Roth prior to 59 1/2 may be subject to taxes and penalties depending on the reason for your withdrawal.

Contribution Source

This significant difference between a 401k and an IRA considers who can open and manage each account. While only your employer can offer a 401(k) plan, anyone who earns an income and has some savings to start the account can open a traditional or Roth IRA through banks, brokers, etc. The income limitation is because some financial institutions require a minimum deposit of $1,000 or more.

Required Minimum Distributions

There is no minimum distribution for Roth IRA (and Roth 401(k) in 2024). Meanwhile, the traditional 401(k) and traditional IRA have required minimum distributions beginning at 73 years.

But for now, only the Roth individual retirement account allows you to escape this stipulation since the Roth 401(k) privilege starts in 2024.

Investment Options

Investment opportunities are significant factors in the 401k vs traditional IRA comparison. With 401(k), you only get the investment options your employer chooses, whether on one investment, like a mutual fund, or spread out between several investments in different types and risk levels. They may include

- Bond funds

- Stock

- Target date funds

- Balanced funds

In contrast, an IRA offers a boutique of investment options from funds to individual stocks, bonds, and certificates of deposit. You should have your IRA planning consultant guide you on the best options, depending on risk level, pre, and post-retirement income, etc.

Planning for retirement? An Individual Retirement Account (IRA) can be a powerful tool in your retirement savings strategy. But, navigating the rules and regulations can be complex. Interactive Wealth is here to guide you through it.

Our IRA Planning services are designed to help you make the most out of your IRA, understanding its benefits, limits, and the best strategies for your personal situation.

Loan Limitations

The general rule for these retirement accounts is to avoid withdrawing before the stated age limit. However, depending on your employer’s account, you can avoid the 401k taxes when you take a loan. But you must repay the loan within the stipulated repayment period, typically not over five years, and you will continue to pay interest in that time, much like a standard loan.

Choosing Between a 401k and an IRA: Which One is Better?

No account is better to have. The 401k and IRA have different benefits, limitations, and features that may suit you, depending on your situation. Usually, 401k investors should contribute enough to match their employer’s contribution.

But besides that, if the available investment opportunities are limited with poor returns compared with IRA, you may have to try opening and funding an IRA account.

Investing in professional tax financial planning will help you analyze your pre- and post-retirement income to determine the type of account to fund in a year.

Can I Have a 401(k) and an IRA?

People often wonder, “Can I contribute to 401k and IRA at the same time?”

Yes, you can contribute to a 401k and a traditional IRA account. The traditional individual retirement account and 401(k) offer tax-deferred savings and tax deductions for any amount contributed to a retirement account each tax year.

People typically choose between a 401k and a Roth IRA. In fact, the US Census Bureau reveals that 34.6% of retirement account owners have 401k-type accounts, while 18.2 own IRA accounts.

After retirement at 59½ years, distributions will be taxable income every year you take them. Even though the IRS has fixed yearly limits on how much you contribute to a 401(k) and individual retirement account, the different tax advantages are significant. Remember that you will only enjoy the tax-deferred growth and tax-free distributions after 59½ years if you contributed with after-tax dollars.

Final Word

Both IRAs and 401(k)s are excellent investment tools with different benefits over each other and limitations. Since 401(k) is an only employer-sponsored plan, your investment opportunities may be limited, yet your contribution limits will be higher than a traditional or a Roth IRA.

The best option is to have an IRA and a 401k concurrently to enjoy the perks of a robust retirement portfolio. You can employ the services of a reliable financial planner to determine your eligibility and other viable investment options.

Interactive Wealth Advisors is a team of professional financial planners dedicated to helping you focus on your business and income to ensure comprehensive wealth management for your golden years.