Only 13.5% choose cash balance plans for their retirement savings. For some people though, combining more than one option is an excellent way to beef up their retirement savings.

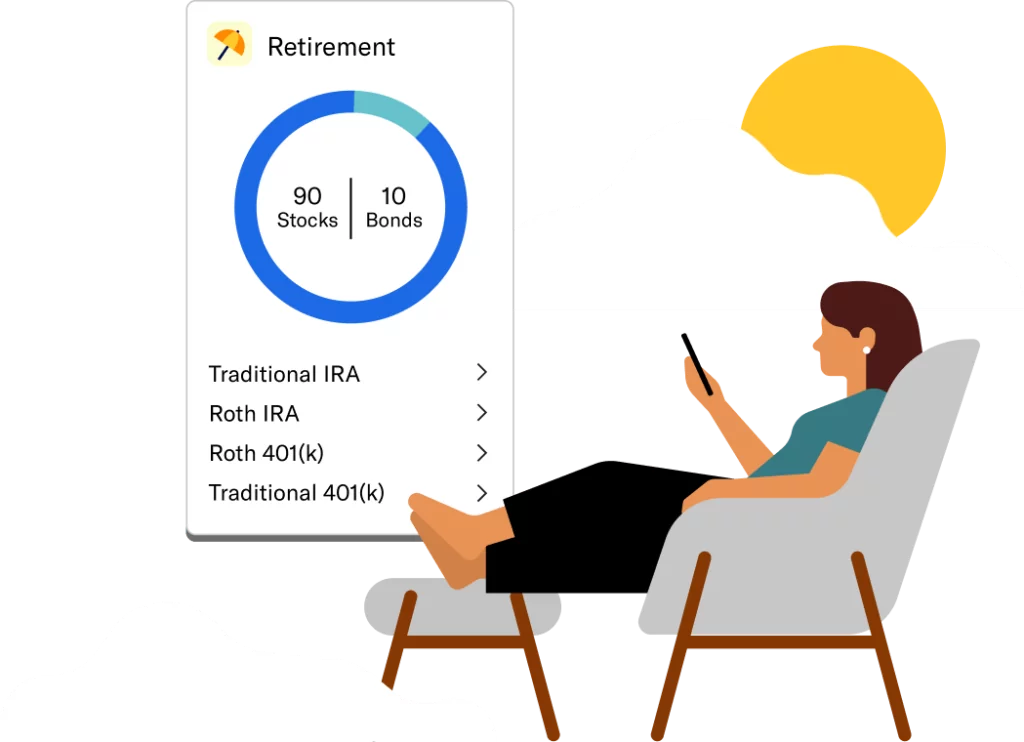

People typically choose between a 401k and a Roth IRA. In fact, the US Census Bureau reveals that 34.6% of retirement account owners have 401k-type accounts, while 18.2 own IRA accounts. In the realm of retirement planning, one common question that often arises is whether an individual can contribute to both an IRA (Individual Retirement Account) and a 401(k) simultaneously. The decision between these two prominent retirement savings options can be quite a conundrum.

With the allure of tax advantages, investment opportunities, and long-term financial security, individuals find themselves seeking clarity on how to strike the right balance between these two avenues. In this article, we will delve into the intricacies of contributing to both an IRA and a 401(k), shedding light on the potential advantages, limitations, and scenarios where this dual strategy might be a viable option.

IRA Eligibility and Contribution Limits for 2023

There are two main types of IRAs: traditional and Roth. A traditional IRA allows you to deduct your contributions from your taxable income, but you will have to pay taxes when you withdraw your money in retirement. A Roth IRA does not offer an immediate tax deduction, but your withdrawals in retirement are tax-free, as long as you meet certain requirements.

Before you get involved in IRA retirement planning, it is important that you know what to expect. The important factors to consider are.

Eligibility

Both traditional and Roth IRAs are open to all income earners.

Contribution Limits

In 2023, IRA allows you to invest pre-tax dollars up to $6,500 and $7,500 for people who are 50 years and above. This is how much you can put in an IRA if you have a 401k.

Withdrawal Rules and Taxes

Contributions to traditional IRAs are tax deductible under traditional IRA rules. Earnings are tax-free. Withdrawals are taxed at income tax rates.

Roth IRA contributions, on the other hand, are not tax deductible. Earnings and withdrawals are tax-free for qualified distributions since the tax has already been paid when investing.

Penalties

According to IRS rules, if you withdraw from your funds early, before you are 59½ years, such withdrawals are subject to a 10% penalty plus gross income tax on the withdrawn amount.

There are certain circumstances where this rule is overlooked though, such as when you are taking the money to meet your medical insurance or after an unexpected job loss.

Minimum Distributions

The required minimum distribution (RMD) is the annual minimum withdrawal from a qualified retirement plan and typically starts at 73 years. To get your RMD, divide your individual savings account value by the Uniform Lifetime Table published by the IRS every year.

Contribution Growth Over Time

Growth depends on the investment choices you make and how much money you put in. Using the 2023 max IRA contribution of $6500, this account would be worth over $460,000 if this amount is invested consistently at 5% annually after 30 years. This would amount to $195,000 in personal contributions over 30 years. More than $260,000 will come from contribution growth over time.

The 80/20 rule, or the Pareto Principle, is widely used in business and economics. It manifests that 80% of outcomes result from 20% of causes.

401k Eligibility and Contribution Limits for 2023

A 401(k) is a type of employer-sponsored retirement plan that allows you to contribute a portion of your pre-tax income to a tax-deferred account. This means that you don’t pay taxes on your contributions until you withdraw them in retirement.

However, not everyone is eligible to participate in a 401(k) plan, and there are limits on how much you can contribute each year.

If you are looking to invest in a 401k retirement plan, these are the factors to consider.

Eligibility

Your employer must provide 401k and, in most cases, make matching contributions.

Contribution Limits

Contribution limits apply to both traditional and Roth 401k plans. For 2023, the max 401k contribution is $22,500, with the option of an extra $7,500 for people who are 50 years and older.

Withdrawal Rules and Taxes

As you may know, 401k contributions are typically tax-deferred. When you retire and start withdrawing, these 401k withdrawals, known as distributions, will now be taxed like regular incomes. States and local governments may also tax distributions.

Penalties

401(k)s are designed to help you have enough money when you retire, stop working, and no longer get a regular income. However, if you are compelled to dip into this fund when you are below 59 years old, you will almost certainly have to pay an early withdrawal penalty – usually 10% of your withdrawal amount.

Minimum Distributions

If you have a 401k plan, your first minimum distribution or RMD can be delayed until April 1 of the year following your 72nd birthday. In subsequent years, you must take the RMD by December 31. The only exception to RMD is if you are still working.

Contribution Growth Over Time

401k growth over time is also subject to compound interest, and the total amount of money you can expect when you are ready to retire will depend on your annual savings out of your annual salary.

The limit for 2023 is $22,500 but suppose you want to peg your contributions at $15,000 yearly for 35 years at 5% interest; you are looking at more than $1,470,000 within this period. Only $525,000 will be personal funds, and the balance will be contribution growth over time.

Matching contributions from your employer also help your 401(k) grow.

Can I have an IRA and 401k Together? How Does It Work?

You can contribute to 401k and IRA jointly if you meet certain requirements. For example, if you earn above a certain threshold, you may not be eligible to use Roth IRA in the first place.

At the same time, you or your spouse having access to a retirement plan at work may affect your ability to contribute to a traditional deductible IRA. You can still contribute to a non-deductible IRA, though.

Having a Roth IRA and 401k together can be good for tax planning purposes; however, sticking to 401k may be a good choice if you cannot claim deductions.

To have a traditional IRA and 401k combination and make the most of it, you may want to first contribute enough to your 401k to take advantage of your employer’s match, then switch to an individual retirement account to take advantage of the diverse investment alternatives it provides.

Withdrawal Rules and Taxes for Both Accounts

Like the idea of incorporating a 401k and an IRA plan? The following tips can help you get started in the right direction.

Ensure you are eligible to contribute to both

High earners may not be eligible to contribute to an IRA and a 401k. So the first step is to make sure you are eligible income-wise. For 401ks, there is no income limit. However, for an individual retirement account, the IRS says your Modified Adjusted Gross Income (MAGI) must be under $153,000 to qualify.

Don’t exceed limits for the year

Limits differ between the two plans. The IRA and 401k contribution limits in 2023 are $6500 and $22,500, respectively. Be sure to keep an eye on your year-to-year contributions so that you don’t go off track.

Work with a financial professional

Finally, consider consulting with a financial expert to assist you in creating a holistic retirement plan that covers 401k plus IRA. An investment management advisor will know how to incorporate these plans in a way that suits your goals.

Interactive Wealth Advisors (IWA) is a cutting-edge investment management company that uses state-of-the-art technology to help clients achieve their financial goals.

Need Help with IRA and 401k Planning and Savings?

Hopefully, this article has answered the question, “Can I contribute to an IRA if I have a 401k?”

Of course, there are people who are happy enough with just one retirement account. At the same time, there are others who prefer to combine several options, typically both a Roth IRA and a 401k.

Interactive Wealth Advisors can help make the most of this combination. We specialize in delivering impartial, fee-only advice and portfolio management to assist our customers in optimizing their wealth. We also provide retirement planning for business owners and can help you determine how much to invest in an IRA and 401k to get the maximum combined benefit.

The path to retirement can be complex, but you don’t have to navigate it alone. Connect with Interactive Wealth Advisors to access expert guidance and create a retirement strategy that fits your life.