While many Americans aspire to retire by the age of 65, a pressing question remains: How much do you truly need to retire in comfort? Can you retire on 1.5 million dollars? While $1.5 million is undeniably a substantial amount, is it enough to guarantee the financial stability required to sustain your preferred lifestyle post-retirement?

Christopher Winn, a seasoned financial advisor in Portland, provides a valuable insight: Ideally, your retirement income should approximate 80% of your last drawn salary. Given that the average US income stands at $59,428, this suggests a retirement fund closer to $2 million.

However, if your target is $1.5 million, it’s essential to recognize the myriad factors influencing how long 1.5 million will last in retirement. Aspects such as your place of residence, lifestyle choices, health considerations, food expenses, housing, and travel ambitions all play a role.

In this article, we’ll dive deeper into the nuances of retiring with a $1.5 million nest egg and the critical considerations to ponder before finalizing your retirement plans. Let’s crunch the numbers together.

Understanding Retirement Income

Planning for retirement involves setting a realistic income target. Most experts advise aiming for 70% to 80% of your pre-retirement income. So, if you earned $60,000 before, you’re looking at $42,000 to $48,000 annually.

However, whether this amount will be sufficient depends on various factors. Recent BLS data shows the average retiree aged 65 to 74 spends about $60,844 yearly. Housing is the biggest expense, around $21,094 yearly, followed by transportation, food, and healthcare. This means $48,000 might be tight.

Fortunately, some tools can help plan your retirement income:

- Online Financial Calculators: These tools let you input your financial details, like savings, expected investment returns, and retirement age, to estimate your income needs.

- Social Security Optimization Software: These tools analyze different claiming strategies to maximize your Social Security benefits.

It is essential to note that while these tools are valuable resources, they should not replace professional financial advice and guidance, especially given the intricacies and unique circumstances that can surround retirement planning.

How Much Money Is Enough to Retire?

$1.5 million net worth—how far does it go in retirement? To figure out this and determine whether it is sufficient for retirement, consider these key factors:

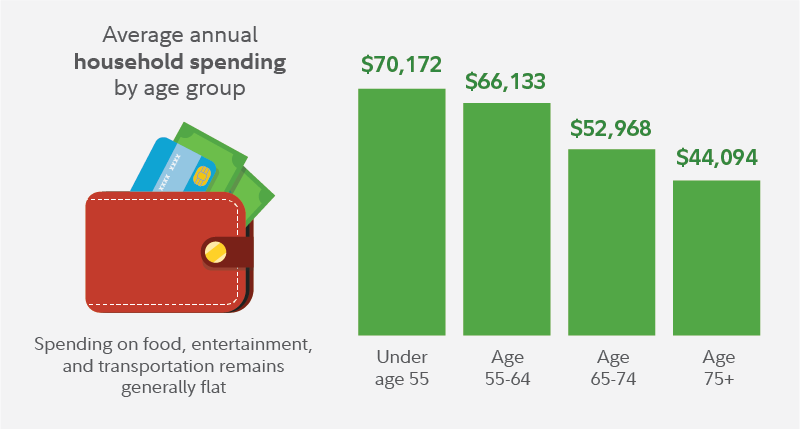

- Lifestyle: Think about your plans. Will you travel, dress stylishly, or host frequent gatherings? Expenses for clothing and entertainment can add up significantly. For instance, clothing costs around $1,357 for those aged 65 and older, while entertainment expenses reach $3,182. It may be difficult to learn how to live off investments with a robust lifestyle so you may want to adjust accordingly.

- Location: Where you live matters. Some states have higher taxes and living costs, while others offer retirement benefits and programs that boost your income. Compare state-specific advantages to make informed financial choices for retirement.

- Healthcare: Rising healthcare expenses are a crucial consideration. Healthcare costs can be substantial during retirement, making up approximately 12.2% of total future expenses according to 2022 BLS data.

- Housing: Housing expenses constitute a significant part of retirement costs, accounting for 34.7% of expenses for older adults. Think about downsizing or relocating to a more affordable area to manage these expenses.

- Food Costs: Food expenses vary based on your lifestyle and dietary preferences. On average, individuals aged 65 to 74 allocate approximately $8,198 each year to cover their food expenses. If your yearly income falls short, consider adapting your eating habits by dining out less frequently and opting for bulk purchases to make your budget stretch further.

By understanding and accounting for these factors, you can better gauge how much money you’ll need to live comfortably after working.

How Much Does the Average American Spend a Year in Retirement

Considering that most American retirees 65 years old and above have about $255,151 in their 401(k)s, while the median balance is $82,297, one thing’s for sure – you’ll need to really save up to live comfortably when you stop working.

So how much does the average American spend in their post-work years? It depends on a number of factors, but according to a recent study released by the Bureau of Labor Statistics, the average American retiree between the ages of 65 and 74 spends about $48,885 a year.

Let’s break these details down using data from the BLS.

Not surprisingly, housing is by far the biggest expenditure for the average retiree. The average yearly housing cost for retirees aged 65 to 74 is estimated to be $15,838. Another unexpectedly high cost of retirement is transportation, which costs $8,338 annually. The average annual cost of healthcare is $5,956.

Of course, these are just averages – your actual retirement costs may be higher or lower depending on your individual circumstances. But it’s a good starting point to help you plan for your own end-of-work years.

Let’s now discuss how much you need to retire and what the ideal retirement age might be.

Retiring Before 45 with $1.5 Million

Can I retire with one and a half million dollars? Having 1.5 million dollars for retirement before age 45 is challenging but doable. The average 45-year-old can expect around 32 more years according to SSA stats. This means living on an annual post-work income of $48,000.

The problem here is how you can save this much money before 45 years old. Easy. By saving $60,000 annually from age 20 until your retirement at 45.

Keep in mind that this is savings only. Integrating smart investing and taking steps to grow your wealth with financial planning will accelerate the process.

Secure your dream retirement now! Take proactive steps towards a comfortable and stress-free future with our expert Retirement Planning services. From financial strategies to investment advice, we’ve got you covered. Start building your nest egg today – click here to explore our comprehensive solutions!

Several people have successfully achieved this, including well-known figures like Mr. Money Mustache, and the Mad Fientist who both retired in their 30s. Their strategies involve:

- Aggressive Saving: Early retirees often save a substantial portion of their income, often over 50%. This may require frugal living, expense reduction, and strict budgeting.

- Smart Investing: Diversified investments in stocks, bonds, real estate, and income-generating assets can help grow savings efficiently while mitigating market volatility.

- Passive Income: Establishing income streams, such as rental properties, dividends, royalties, or online businesses, can provide passive income to live comfortably at retirement.

- Financial Safety Nets: Early retirees build an emergency fund to handle healthcare costs, as they may not be eligible for Medicare until age 65.

Can you retire at 45 with $1.5 Million

The four percent rule is a well-established guideline in retirement planning. It recommends withdrawing 4% of your initial retirement portfolio balance in your first post-work year and then adjusting this amount annually to account for inflation. This strategy is designed to help you manage your funds effectively throughout your post-work years.

For instance, if you have a net worth of 1.5 million, following this rule would mean withdrawing $60,000 (which is 4% of $1.5 million) in the first year. By annually adjusting this withdrawal to accommodate inflation, your retirement savings are likely to last for 30 years or even longer.

However, seeing as the inflation rate may vary each year and considering that a 45-year-old may live around 32 more years, targeting yearly expenses below $46,000 is prudent. Remember, not everyone can live on this budget.

Factors affecting this rule include:

- Variable Withdrawals: You can adjust annual withdrawals based on portfolio performance, spending more in good years and less in challenging ones.

- Portfolio Performance: A successful plan relies on investment performance meeting or exceeding expectations.

- Additional Income: Explore extra income sources like rentals or part-time work to ease reliance on your savings.

- Market Volatility: Diversify your investments to mitigate the impact of market fluctuations.

So, can you retire on 1.5 million at 45? Yes, you can. But you should be willing to work hard at it. If you live in Oregon and its environs, leverage the services of investment management consultants in Portland, OR so that you can have a tailored retirement plan aligned with your goals and risk tolerance.

Can you retire at 55 with $1.5 Million

If you have $1.5 million saved and aim to retire at 55, you can. However, this depends on your withdrawal rate – how much you consistently take from your savings – and how long you live.

The 4% withdrawal rule suggests taking 4% of your initial nest egg in year one, adjusting for inflation yearly. However, the success of this strategy relies on your investment portfolio’s performance. Your investment returns must match or exceed your withdrawal rate to have a better chance of making your savings last.

The feasibility of retiring at 55 with 1.5 million also depends on several factors, including:

- Lifestyle and Expenses: Your annual expenses play a significant role. To make a 4% withdrawal rate work, you may need to adjust your yearly expenses.

- Additional Income: Explore other income sources like Social Security, rentals, part-time work, or passive income.

- Market Volatility: Be prepared for market fluctuations, which can impact your portfolio’s performance. Diversifying your investments can help manage risk.

- Longevity Risk: Recognize that retiring at 55 may mean decades of no work compared to someone retiring at 64; plan accordingly.

Can you retire at 65 with $1.5 Million

Recent surveys indicate that Americans believe they’ll need around $1.27 million for a comfortable retirement, with those in their 60s aiming for about $968,000. Working with this benchmark, it is feasible to live off 1.5 million. For a 65-year-old with an average life expectancy of 17 years, that’s roughly $85,000 yearly for expenses.

Of course, certain factors come into play here.

- Social Security Benefits: Social Security is a significant income source, and optimizing your claim timing is crucial. Claiming early reduces payments, while delaying can lead to larger checks.

- Retirement Lifestyle: Today’s retirees often pursue active lifestyles, travel, or part-time work. Budgeting for these activities is essential. Some downsize or explore different living arrangements.

- Healthcare Costs: Again, budgeting for healthcare is vital. Medicare starts at 65, but private insurance may be necessary until then. Long-term care insurance is an option to manage potential healthcare expenses.

- Inflation: Inflation reduces your purchasing power over time. Consider an inflation-adjusted withdrawal strategy, like the four percent rule, to counter rising costs.

- Part-Time Work: Many older adults work part-time for extra income and to stay engaged. A phased retirement approach can help ease the transition while boosting your finances.

Retirement for a Couple with $1.5 Million

Is one and a half million dollars enough for a couple to retire on?

A couple with $1.5 million in retirement savings can withdraw $60,000 each year. When this sum is combined with their other income sources, it can indeed ensure comfortable post-work years.

For example, Social Security benefits can significantly impact joint retirement planning. On average, couples can anticipate a combined monthly Social Security income of $2,972, equivalent to an annual total of $35,664. This provides a significant financial foundation for their post-work years.

Meanwhile, the remaining amount can continue to grow through investments in stocks, bonds, and other assets. This growth can contribute to their financial security and sustainability throughout retirement.

Factors Affecting Your Retirement Savings

Whether you have saved up 1.5 million dollars to invest or aiming for $2,000,000, it’s crucial to understand that certain factors can affect your savings.

They include:

- Withdrawal Rates: The percentage of your savings you withdraw annually impacts how long your savings will last in retirement. Higher withdrawal rates deplete savings faster.

- Employer Benefits: Employer-sponsored plans, like 401(k)s, can significantly boost your savings, thanks to employer contributions and tax advantages.

- Investment Returns: The performance of your portfolio affects the growth of your retirement savings. Higher returns mean more savings over time.

- Inflation: The continuous rise in prices gradually erodes the purchasing power of your savings. To preserve your standard of living, it’s crucial to account for inflation when determining your savings objectives.

- Debt Level: Elevated debt levels, especially with high-interest obligations, can redirect funds away from your retirement savings, impacting your financial security during retirement.

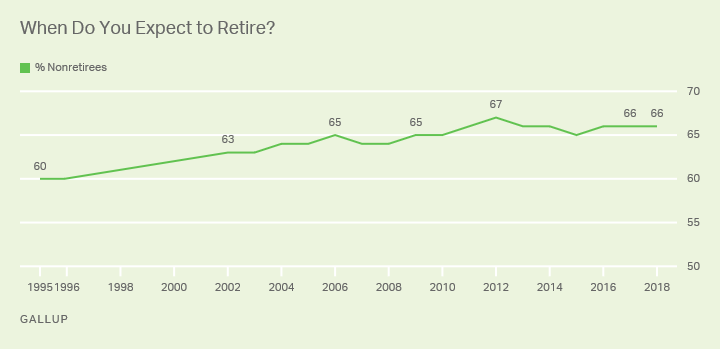

- Retirement Age: The age at which you plan to stop working influences how much you need to save. An early retirement typically requires more savings.

- Healthcare Costs: Healthcare expenses can be a significant part of post-work years costs. Planning for medical bills is crucial to avoid depleting savings.

- Tax Strategies: Tax-efficient saving and withdrawal strategies can maximize retirement savings by reducing tax liabilities.

- Life Expectancy: Longer life expectancies require more substantial savings to ensure financial security throughout retirement.

- Government Benefits: Access to government programs like Social Security can provide additional retirement income and impact savings strategies.

- Retirement Lifestyle: Desired lifestyle choices, such as travel or hobbies, can influence savings goals and the amount needed for a comfortable retirement.

These factors all underscore the importance of adaptability in long-term financial planning. Regularly review and adjust your retirement plan as circumstances change to ensure secure and comfortable golden years.

Tax Reduction Strategies

Beyond setting aside funds, it’s important to also explore strategic ways to minimize tax burdens.

- Maximize Retirement Contributions: Contribute to tax-advantaged accounts like 401(k)s, IRAs, and Roth IRAs. They offer tax benefits like pre-tax contributions or tax-free withdrawals in retirement.

- Catch-Up Contributions: If you’re 50 or older, use catch-up contributions—up to $7,500—to boost savings. These allow extra contributions beyond regular limits, reducing taxable income in your final working years.

- Consider a Roth conversion: Convert funds from a traditional IRA or 401(k) into a Roth IRA. While the converted amount is taxed in the conversion year, future Roth IRA withdrawals remain tax-free. This can be especially valuable if you anticipate a higher tax bracket in the future.

- Health Savings Accounts (HSAs): Contribute to HSAs for tax deductions and tax-free growth, primarily for medical expenses. In retirement, HSA funds can be used for non-medical expenses, subject to income tax.

- Qualified Charitable Distributions (QCDs): Once you reach age 72, required minimum distributions (RMDs) from traditional retirement accounts become mandatory and are taxable. To minimize taxes, plan RMDs carefully. Consider using QCDs to fulfill RMDs through direct charitable donations of up to $100,000 from retirement accounts, reducing your taxable income.

Keep more of your hard-earned money! Discover powerful Tax Reduction Strategies that can help you minimize your tax liabilities and maximize your savings. Our expert team is ready to guide you through smart financial tactics. Don’t let taxes drain your wealth – learn how to save big

Keep in mind that tax laws can change over time, affecting the effectiveness of these strategies. Stay informed about current tax regulations and consider consulting a tax professional or financial advisor to tailor these strategies to your financial situation and any potential tax law changes.

Financial Milestones for Successful Retirement

Can I retire on $1.5 million or do I need more or less? When it comes to retirement, the amount of money you need to save can vary greatly depending on your savings plan and the lifestyle you wish to have in your golden years.

One source suggests saving 15% of your gross earnings in your twenties and continuing until you stop working. This should include savings in different accounts as well as any employer-matched contributions.

Another way to achieve this is by working with the table below.

| Age | Milestones |

| 30 | 1x your income |

| 35 | 2x your income |

| 40 | 3x your income |

| 45 | 4x your income |

| 50 | 6x your income |

| 55 | 7x your income |

| 60 | 8x your income |

| 67 | 10x your income |

This means that for an income of $80,000, you should have saved up $640,000 to retire at 60. Investing just 50% of this amount over the rest of your life or for 20 years with an estimated 5% return will add more than $800,000 to your pot.

Retirement Planning Tips

Do you know that only about 10% of Americans have up to $1 million in savings? Could this mean that hitting your target of 1.5 million dollars is impossible? No, it isn’t.

Here’s what you can do to meet your target.

- Start Early: Commence your savings journey in your 20s or 30s. Beginning early allows you to benefit from compounding and ensures you’re not hindered by later-life responsibilities.

- Set a Target: Aim to save at least 10% to 15% of your annual pretax income for retirement. If you’re falling short, make an effort to increase your savings rate gradually.

- Tackle High-Interest Debt: Prioritize paying off high-interest debt and credit card balances. Clearing these financial hurdles will free up more money for savings.

- Explore High-Yield Investments: Consider high-yield investments that offer better returns than traditional savings accounts. Be sure to work with a registered retirement consultant to determine options that make sense so you don’t lose all your money.

- Tax-Efficient Strategies: Rather than relying solely on your standard savings account, explore the benefits of a Roth IRA. Contributions made to a Roth IRA are tax-free, and your investment grows without incurring taxes until you reach end-of-work age. Embrace Roth IRA planning to maximize the advantages of this tax-efficient strategy for your retirement savings.

- Retirement Planning Tools: Leverage tools like online calculators, robo-advisors, and retirement planning software to help make informed decisions and track your progress toward your future goal.

Although both plans offer significant tax benefits, the difference between a 401k and IRA is that employers provide 401(k)s, while individuals open and control IRAs via brokers or banks.

Remember, every individual’s financial situation is unique, so tailor these strategies to fit your needs and consult with professionals for personalized guidance.

Conclusion

The journey to retiring with $1.5 million requires proactive planning that takes into account your unique circumstances and the ever-evolving financial landscape. This is where we come in at Interactive Wealth Advisors (IWA).

At IWA, we understand the importance of personalized financial planning. So, whether you’re just starting, have questions about your existing retirement plan, need help with financial estate planning, or want wealth management for business owners, we’re here to help.

Contact Interactive Wealth Advisors today for a tailored retirement plan that aligns with your dreams and aspirations.

Book a call to get started.