401(k) plans and health insurance are two of the top must-have benefits for employees according to a Schwab survey. In fact, 86% of respondents say that an employer-sponsored retirement plan will help boost workers’ confidence about achieving retirement goals, making them stay with the business long-term.

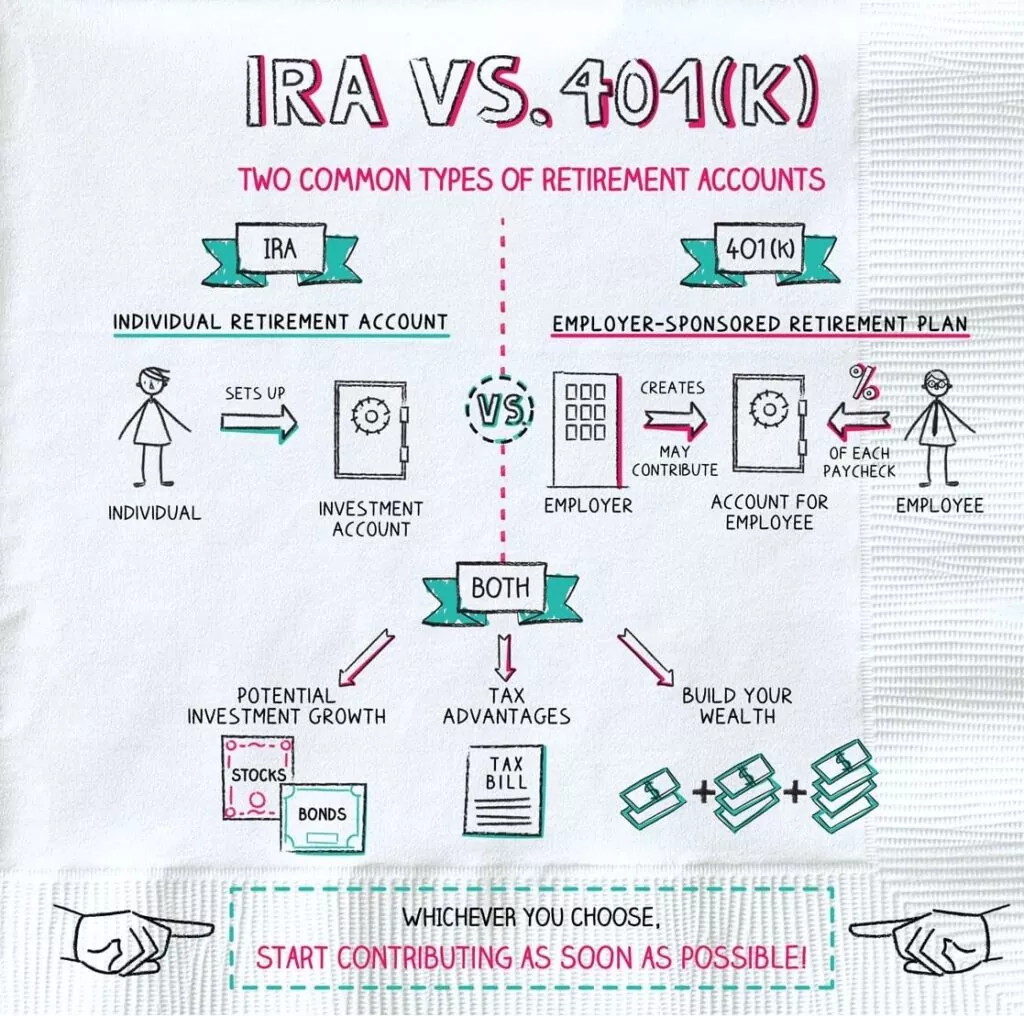

Unfortunately, navigating the world of IRA planning can be tedious, particularly for small business owners with employees.

This guide will provide a detailed overview of the 401k for sole proprietors, and how to choose and manage a plan that meets the needs of your business.

Why 401(k) Plans?

Wondering what the benefits of a 401k plan are?

- First, 401k is a great way to attract and retain employees. With a 401k plan in place, your employees will have the peace of mind of knowing that they have retirement savings all set up. This can be a big selling point for your HR department.

- Another benefit for 401k business owners is that they can be used as a tool for tax planning. By contributing to a plan, you can reduce your taxable income and your overall tax liability at the end of the year.

- On a personal note, 401k for a business owner can offer peace of mind in retirement. With a 401k, you’ll have the security of knowing that you are securing a nest egg for yourself. This can be a big weight off of your mind as you can’t always count on your company remaining lucrative after you’ve left.

What are the Types of 401(k) Available?

When it comes to saving for retirement, small business owners have a few different options available to them. The top 401k options for small businesses are:

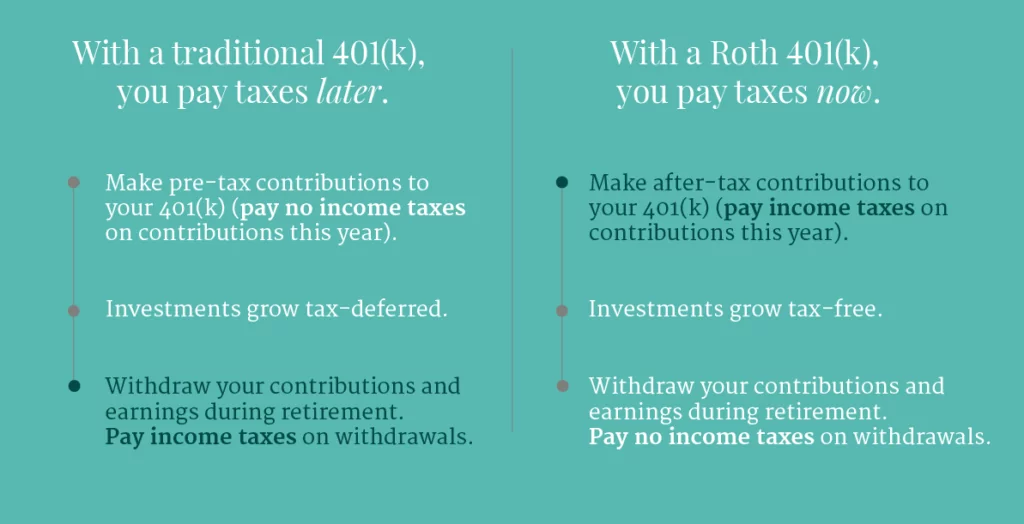

- Traditional 401(k)

The traditional 401(k) is the most common type of 401(k) plan. Here, employees can elect to have a portion of their paycheck withheld and deposited into the account. This money is not subject to federal income tax, which can result in significant tax savings. Employers may also choose to make matching or non-elective contributions to employees’ traditional 401(k) accounts.

- Individual or Solo 401(k)

An individual 401(k), also known as a solo 401k, is a retirement savings plan designed for business owners with no full-time employees. With this type of plan, the business owner sets up a 401(k) account with a financial institution and makes contributions to it. The benefits of this approach are that it can be done relatively easily and quickly, and the business owner has a lot of control over how much money goes into the account.

- SIMPLE IRA

If you have 100 or fewer employees, you might want to consider a SIMPLE IRA. In this Savings Incentive Match Plan for Employees (SIMPLE) plan, employers are expected to contribute up to 3% of each employee’s salary or 2% in non-elective contributions with business owner 401k contribution limits of $330,000 annually. Employees cannot contribute more than $15,500 per year ($18,500 if 50 or older).

- Safe Harbor 401(k)

The Safe Harbor 401(k) is a type of 401(k) plan that allows employers to get around the IRS’s nondiscrimination test. Under the safe harbor 401k contribution rules, employers are required to consistently match employee contributions or make non-elective contributions on behalf of all eligible workers.

- Roth 401(k)

The Roth 401(k) combines features of a traditional 401(k) and a Roth IRA; however, unlike a traditional 401(k), contributions to a Roth 401(k) are made with after-tax dollars.

This implies that any withdrawals made during retirement, including investment profits, are tax-free.

Some businesses will offer to match the Roth 401(k) contributions made by their workers.

However, the IRS says that these should be regarded as contributions to a traditional 401(k), which means they will be taxed upon withdrawal.

How a Small Business 401(k) Works

401(k) for a small company works pretty much the same as it does for a large business.

- Employees can elect to have a certain percentage of their pretax dollars withheld and deposited into their 401(k) account, up to the annual contribution limit set by the IRS (currently $22,500 for 2023).

- Employers may choose to offer a matching contribution to their employees’ 401(k) accounts up to a certain percentage of their salary.

- The money in the account grows tax-deferred until the employee retires and withdraws.

It is important to point out here that it can be tricky to set up a 401k for a small business, so you may need financial planning for business owners to help you set one up and manage it.

How Does a 401k Work for the Self-Employed?

For many people, a 401k is an employer-sponsored retirement savings plan. However, there are also self-employment 401k plans or SE 401k, such as the Solo 401(k).

Here’s how a 401k for self-employed works:

- The self-employed person sets up a Solo 401(k) plan with a bank or investment firm.

- The individual can contribute both as an employer and as an employee to the plan.

- As an employer, the individual can contribute up to 25% of net self-employment income, with sole proprietor 401k contribution limits capped at $66,000 a year.

- As an employee, he or she can also contribute to the plan up to the annual limit of $22,500, or $30,000 if they are over 50.

- Contributions made to the Solo 401(k) plan grow tax-deferred until the individual retires and begins to withdraw funds. At that point, withdrawals are not subject to a tax deduction.

Again, setting up and managing a Solo 401(k) can be complex, however, investing in retirement planning consulting will help you get it right.

Can Owners of an LLC Contribute to a 401(k)?

The short answer is: yes, 401k for LLC is possible as long as they meet certain eligibility requirements put in place by the IRS.

For example, your activities within the business must be considered self-employment by the IRS. The IRS does not regard a member’s inactivity in an LLC as constituting self-employment. To establish a 401(k), you must be actively involved in the administration and operations of the business.

How Much Can I Contribute to My Business 401k?

How much can you put in a 401k? The answer depends on a few factors, including the type of 401k you choose, the amount of income your business generates, how many employees you have, and the small business 401k contribution limits set by the IRS.

Here are some general guidelines:

- Each employer’s total employee and employer contribution to all of its plans are limited to the lesser of

- A total of $66,000 per year, or 100 percent of the employee’s compensation.

- Employee contributions are limited to $22,500.

- The catch-up contribution limit for employees aged 50 and over is $7,500.

How to Decide Which 401k is Best for You?

Business owners can use the following tips and best practices to select the most efficient 401k savings option:

- Take your business needs into account.

- Select a plan with a low fee structure.

- Choose a plan that offers you a variety of investment options.

- Choose a plan with real-time payroll integrations.

- Consider a plan that provides employees with personalized guidance.

- Get professional advice.

The Final Take

Whether you have 2 employees or 100, one of the most important benefits you can give your workers is the 401k. But figuring out the 401k rules for small businesses can be challenging. That’s where Interactive Wealth Advisors can help.

We’re a licensed financial planner in Portland, Oregon, and can help you navigate the world of 401k for business owners. We’ll work with you to figure out which retirement plan is right for you, 401k profit-sharing rules and contribution limits, as well as how to make the most of your 401k.

We also offer a host of other services targeted at small business owners including selling business advice, transition planning, and business owner planning.

Contact us today to learn more about our services for small businesses and how we can help you reach your retirement goals.