As a small business owner, you’re likely juggling tons of responsibilities to keep your business running smoothly and efficiently. These responsibilities include anything from accounting, marketing, and sales, to production, inventory management, and personal responsibilities. On top of that, you’ll probably have even more pressing tasks waiting – like keeping your business and personal finances in order.

If you’ve recently started your own business, or are about to launch one soon, balancing all the different responsibilities along with your personal life can be a challenge.

The good news is that you’re not alone – 66% of small businesses also face financial challenges stemming from poor financial management practices, bad sudden wealth management advice, overwhelming debts, and more.

At Interactive Wealth Advisors, we believe that wealth management for business owners doesn’t have to be difficult. In this article, we’ve outlined the best financial planning practices and tips for investing for small business owners.

What is Financial Planning for Business Owners?

Financial planning for small businesses is largely about putting your money to work for you while minimizing the risks. In other words, it’s the process of managing your finances in a way that helps you reach your financial goals.

Financial planning for business owners also entails creating a well-thought long-term strategy for your firm. It goes beyond short-term needs like raising capital to invest in new equipment or taking out a loan to pay for general business expenses.

A good financial plan will help you determine where you want your company to be in a couple of years’ time. It should also give you an idea of how much money you will need now and in the future – which could mean establishing a retirement fund and putting aside cash for future expansion or other unforeseen circumstances.

Why Should a Business Owner Do Financial Planning?

Financial planning enables a business to anticipate upcoming expenses and prepare adequately. It’s also used to manage present assets and understand future risks and opportunities related to money.

The result of financial planning is a set of goals with accompanying actionable steps on how to get there. As an owner, you need to take responsibility for your company’s future success by creating a solid financial plan that helps you make the right decisions at all times.

7 Financial Tips for Small Business Owners

Starting and operating a small business comes with many costs. From buying supplies to hiring employees, small business owners must be prepared to invest their own money. But as a small business owner, there are several financial tasks you cannot overlook.

That said, here are small business financial tips to get you started:

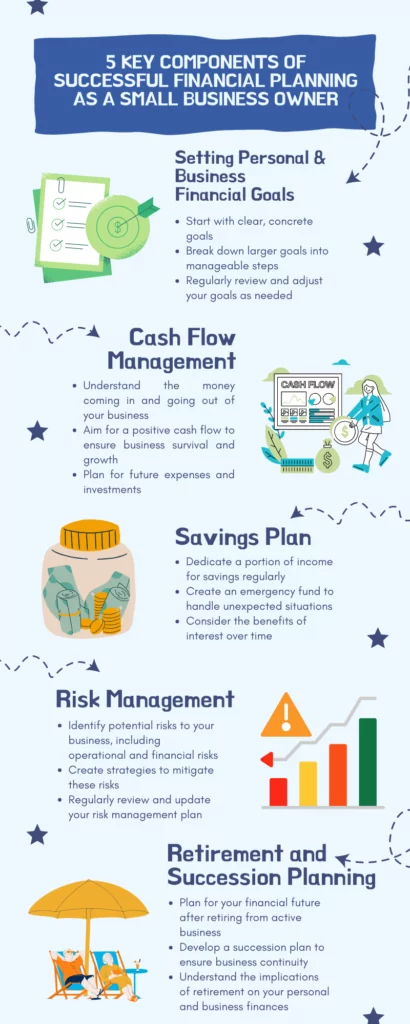

1. Set Personal and Business Financial Goals

Financial goals are what keep you on track toward meeting your long-term financial objectives. They allow you to break down larger, more abstract goals into more manageable and concrete steps.

First, you need to set your goals by answering these questions:

- What are you trying to achieve with your finances?

- What products and services do you want to get into?

- Where do you want your business to be in the coming years?

- Do you want to start a family?

- Send your kids to college?

- Retire early?

Once you know what you’re working towards, you can map out the steps you need to take in order to reach those goals. And that’s where business owner financial planning comes into play. By setting smaller, more immediate goals, you can ensure that you don’t lose track of your larger ambitions.

2. Focus on Improving Your Cash Flows

Cash flow management is one of the most important aspects of financial planning for small business owners. A cash flow refers to the amount of money that is moving in and out of your business on a regular basis. By improving your cash flows, you can ensure that the money you need to survive and thrive is always readily available.

For example, if you’re planning to purchase a house or vehicle as a small business owner, your business needs to have a strong cash flow and dependable monthly income. Otherwise, you may get stuck in an endless cycle of borrowing from friends or family and risk damaging your relationships in the process.

By streamlining your cash flows and increasing your available funds, you can avoid relying on outside sources of income and keep the financial strain off your loved ones.

3. Create a Savings Plan

A savings plan is a financial tool that helps you set aside money regularly for a specific purpose. By creating a solid savings plan, you can avoid falling victim to the financial stress of overwhelming debt. By setting aside a portion of each paycheck, you can also ensure that you don’t miss out on the benefits of interest and that you have the security of an emergency fund or retirement fund at your disposal.

4. Risk Planning and Management

Financial management for small business owners also entails risk management. Risks are a part of any business, but that doesn’t mean leaving them for another day. Small businesses face risks such as:

- Natural disasters

- Fire and water damage

- Reputational risks

- Operational risks

- Financial risks

By taking proactive steps to manage your company’s risk, you can reduce the overall risk burden and boost your chances of success.

5. Plan for Retirement and Succession (The Exit Strategy)

Retirement is an inevitable part of your financial future. It’s the point at which you stop working in your business and begin living off of the money you saved during your working years.

On the other hand, succession is the process through which entrepreneurs choose their business’s successors (people will run your business long after you’re gone). These are the people who will take over your business and the people who will inherit your assets.

A seasoned financial advisor for retirement planning in Portland can help set up a solid retirement plan for your business. These professionals outline the types of retirement plans available for small business owners, tax obligations, and other benefits you’re entitled to.

At Interactive Wealth Advisors, we offer retirement consulting in Portland and help our clients create secure business exit strategies that keep their businesses in times of retirement.

6. Tax Planning

Taxes are a fact of life, but they don’t always have to be an unmanageable burden. You can use tax planning strategies to avoid double taxation and hefty fines and fees for unfiled tax periods.

For instance, many small businesses can take advantage of tax breaks that larger corporations may not qualify for based on their earnings. And, while you can certainly handle some financial tasks on your own, others require expert help. Hiring a financial consultant for small businesses can help plan for taxes, retirement, and other financial challenges that come with small business ownership.

7. Estate Planning

Portland estate planning is a proactive process that involves creating and implementing a plan to manage your assets, reduce potential risks, and ensure your wishes are fulfilled in the event of incapacitation or death. Establishing a will is considered the most basic form of estate planning, but you should also consider powers of attorney, life insurance, and other options to help your loved ones navigate their way in case of your death or incapacitation.

Do You Need a Financial Advisor as a Small Business Owner?

Proper management of the company guarantees returns on the initial investment and provides sufficient coverage of ongoing expenses for many years to come. But, as with any venture, starting and sustaining a small business requires careful preparation with help from your trusted investment firm in Portland, Oregon.

Small business owners need to make lots of financial decisions about sourcing capital for startup costs, managing monthly expenses and taxes, reinvesting profits, or retirement planning if you someday want to sell your company. Many new business owners hire an accountant or wealth management advisor to help manage these complex tasks.

A financial advisor acts as a fiduciary who helps you explore the various financial options available to you and your business. They’re experts in accounting principles, tax codes, and financial statement analysis for small businesses.

Financial advisors can help you manage your money and plan for the future. They aren’t just consultants – they are financial specialists who can offer advice in a particular area of finance.

How to Choose a Good Financial Advisor for Your Business

Ultimately, a financial advisor’s job is to help you improve your financial situation. A good financial advisor will provide advice and suggestions tailored to your goals. A financial advisor can help you with many things related to business finances, including how best to invest your money to grow your business. But how do you know if an advisor is right for your business?

Here are a few things to keep in mind when choosing a financial advisor:

- Look for an advisor who is familiar with small businesses and has experience working with them. He or she should be able to discuss the unique challenges that come with running a small business.

- Next, look for an advisor who will act as a fiduciary, meaning he or she must act in your best interests. In the process, be sure to check out how they charge for their services, the fees, and the range of services provided.

- Determine your financial advisor’s experience. Is he or she a professional who has worked in the financial industry for a long time? If so, how much experience does he or she have in your particular line of business? Does he or she have a good reputation with customers?

- Finally, you should look for an advisor who is independent and objective. He or she should be able to give you practical advice and provide a range of solutions to any business problem. This can help your business succeed in the long run.

As a small business owner, one of your most important goals is to protect your assets from potential lawsuits or claims. Many small businesses choose an LLC or S-corporation structure to protect their personal assets from being taken by creditors (including banks) and other claimants. Being experts in their field, financial advisors can also help you choose and set up the right business structure suited to your needs and goals.

At Interactive Wealth Advisors, we offer small business financial advice to help entrepreneurs like you navigate the complex financial world.

Summing Up

The stakes in a small business are higher than they would be in a more standard job; as a small business owner, your company is your primary source of income and retirement savings all in one. But don’t let that deter you! Financial planning for small business owners doesn’t have to be a daunting task. In fact, it should be the opposite – with a small business financial planner at your disposal.

Are you in need of professional financial planning services in Portland, Oregon? Book a call with us today!